Correspondent banking relationships (CBRs), which enable the provision of domestic and cross-border payments have recently been terminated by global banks in jurisdictions such as Africa, Latin America and Asia Pacific.

The most likely reason is that current payment models lack critical information as to who the direct and indirect participants are and transactional history. Consequently, in view of Anti-Money Laundering and Anti-Terrorist Financing rules (AML/ATF) and to mitigate reputational damage and credit risks correspondent banks are closing CBRs. Against the backdrop of low profitability and rising costs associated with strengthened regulatory compliance in light of Know Your Customers Customer (KYCC) rules, enhanced enforcement and tax transparency, individual banks have cut CBRs or increased the prices charged for this service based on a cost benefit analysis.

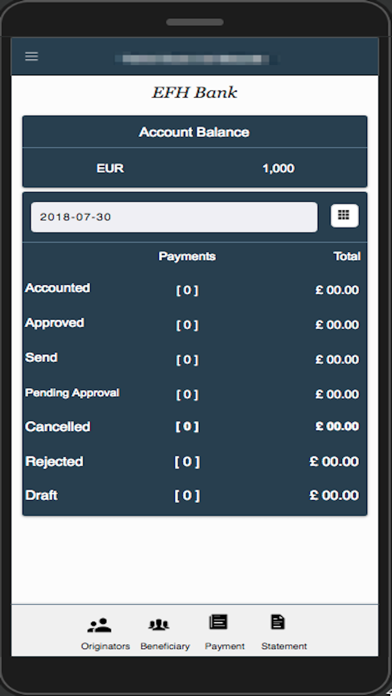

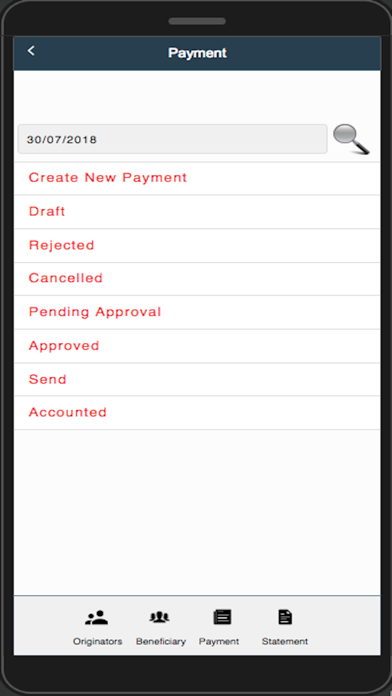

Elemental intends to fill this gap by being a specialised entity with the systems, specialist staff and methods to be able to view and evaluate all aspects of any transaction and then make informed decisions as to its risk and compliance-related elements.

The founders of Elemental, have invested in the creation of proprietary AML/ATF screening, monitoring, value tracking and abnormalities detection. Through this enterprise-class system it is possible to view all direct /indirect components and underlying information to a transaction as well as the financial histories of all participants within the ecosystem and therefore accurately evaluate its risk profile. Elemental aspires to leverage these methods and systems to provide a solution to the wholesale closure of CBRs by traditional Correspondent Banks and at the same time create a purely transactional banking institution in the world’s foremost financial services hub, London.